Marriage Penalties in Social Security Programs

Marriage penalties in tax and social insurance systems have been the source of much controversy in the U.S.; in fact, recent reforms to these systems have been designed in part to reduce them. A marriage penalty exists if two individuals pay higher taxes or receive lower benefits as a married couple than they would if unmarried. Economic theory suggests that by raising the cost of being married, marriage penalties may lead to lower marriage rates. Critics allege that by discouraging marriage, the penalties violate basic principles of equity and efficiency, undermine family values, and negatively affect child outcomes.

Past research has found that marriage penalties have only a very modest effect on marriage rates. However, this relationship is inherently difficult to study because the size of the marriage penalty is usually determined by factors such as family income that may have their own effect on marriage rates. For example, if high-income couples have both larger penalties and higher marriage rates, this may reflect that these couples have a higher underlying propensity to marry, rather than that marriage penalties encourage marriage.

In The Married Widow: Marriage Penalties Matter! (NBER Working Paper 9782), Michael Baker, Emily Hanna, and Jasmin Kantarevic exploit a change in the Canadian social security system to revisit the effect of marriage penalties on marriage decisions. The reform allowed surviving spouses of deceased workers to keep their survivor benefits upon remarriage starting in 1984 in Quebec and in 1987 in the rest of Canada. The marriage penalties eliminated by this reform were substantial - prior to the reform, a typical widow aged 45-59 in Quebec would lose $500 (2001 Canadian dollars) a month by remarrying.

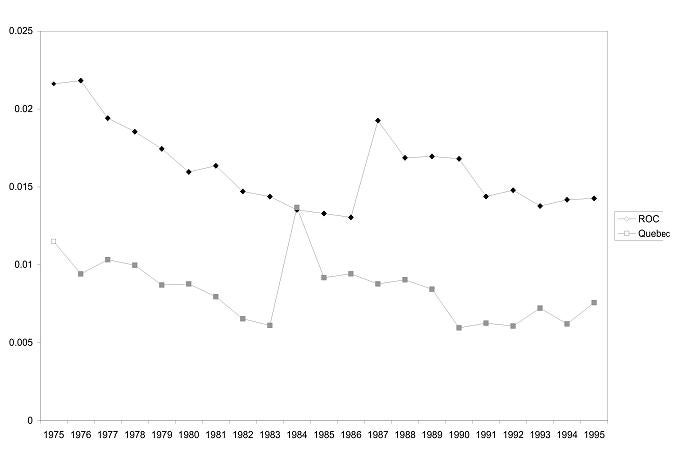

The data for the analysis comes from a vital statistics marriage file maintained by Statistics Canada and covers the years 1975-1995. The authors' empirical strategy is to look at the change in the remarriage rates of widowed males and females in the affected provinces in the post-reform vs. pre-reform period, using the change in remarriage rates in unaffected provinces over the same period to account for any general time trends.

Figure 1 illustrates this approach for widows aged 45-59. There is a downward trend in remarriage rates in all provinces over the period. In 1984, the remarriage rate jumps up sharply in Quebec while continuing its slow decline in the other provinces; in 1987, this is reversed, with a sharp increase in the remarriage rate for the rest of Canada but no change in Quebec. In both cases, there is a large spike in the year of reform and a permanently higher level, suggesting that there was a stock of widows waiting to remarry but also that the reform had long-term effects on marriage activity. Results are similar for men of this age and for younger women, though less conclusive for younger men and older people. The authors estimate that for women under 65, removing the marriage penalty caused remarriage rates to increase by 24% to 100%

Finally, the authors find some evidence that wealthier and more educated persons responded more to these reforms. They suggest that this is consistent with the theory that high-income people receive greater benefits from marriage because the laws covering the treatment of income and assets are most applicable to them. The authors conclude that marriage penalties do have a significant effect on marriage decisions.

This research was funded by SSHRC and was summarized by Courtney Coile.